Passive income for Q1 2021

For the 1st quarter of the year, I received SGD 762.11 from my local SG stocks portfolio, and USD 32.35 from my LSE ETF/US stock portfolio. I’ve since stopped buying SG stocks (ETFs not included) from mid 2020, except perhaps when there’s a correction for some stocks on my watchlist. Hence, I would not be updating my dividends income monthly, but rather on a quarterly basis.

Portfolio Updates

During the WallStreet Bet (WSB) GME period, I sold off PLTR for some small profits at 36.1 on 26 Jan. I also bought some 3067 at an average price of 19.38 in Jan/Feb period, and some Alibaba shares in mid-Mar during the tech sell-off.

Investing in Endowus using CPFOA

I signed up for the Endowus account in Feb 2021, and deposited $1000 from CPFOA to invest in the LionGlobal Infinity US 500 Stock Index Fund and the LionGlobal Infinity Global Stock Index Fund. The key reason behind the signup is that I could use CPFOA to invest in S&P 500 and also the Global Stock Index. I received an SMS notification on 18 Feb that S$1000 was deducted from my CPFOA, but when I checked the Endowus app, the purchase for units of the LionGlobal Infinity US 500 Stock Index Fund and LionGlobal Infinity Global Stock Index Fund was dated 16 Feb 2021. Looks like the order will be executed on the day itself, if there’s sufficient funds in the CPFOA account, and funds would be deducted at T+2 period.

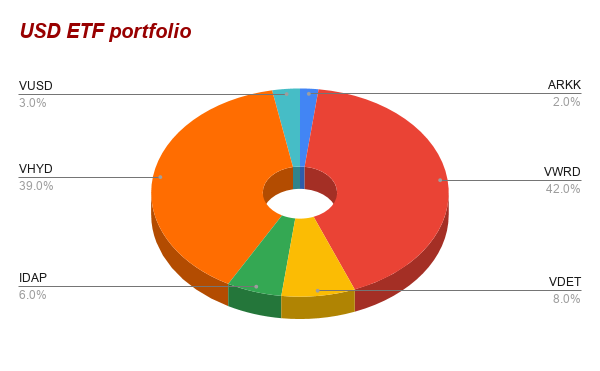

USD-denominated ETFs

During the period, I continued to purchase VWRD, VDET, VUSD and IDAP. Current ETF portfolio composition is as below. I may pick up some more VDET in future to boost the holdings to ~10%.

Crypto learning

I decided to set aside a small sum (around 5K) to invest in cryptocurrencies. Did some digging on the various exchanges out there, and set up accounts with Binance SG, Binance and Gemini. There are withdrawal fees incurred when cryptocurrencies are transferred from one platform to another, although exchanges/platforms like Gemini or BlockFi offer limited monthly free withdrawal.

Apparently, it is possible to transfer “funds” from Binance SG to other platforms at a low cost using Litecoin (LTC). See the medium article here. There is however a risk in this method, where it may not be so effective, when the price of LTC drops a lot after you have purchased them. So it is only better to buy when LTC price is on the uptrend.

If you would like to start an account to invest in crypto, suggest to take it slow and set up Binance SG and also Binance, Gemini account. Binance SG and Gemini offer a direct way (via Xfers) to purchase cryptocurrencies without the need to change your SGD to USD, although there is an annual spending limit of SGD 30K.

Binance, on the other hand, is an international cryptocurrency exchange, where a lot of different cryptocurrencies are listed. The buy/sell rates offered are more competitive at 0.1% (0.075% if you have Binance coin [BNB] on your account), compared to 0.6% from Binance SG when purchasing cryptocurrencies. For larger purchases, it may be more cost effective to buy via Binance instead of Binance SG.

If you are keen to start a Binance account, you could use my referral to sign up for a Binance account.

That’s all for now.